Houzez Theme Review: Google Trends Data Analysis for 2026 and What Google Trends Data Really Reveals

This Houzez WordPress theme review examines Google Trends data, keyword research, real estate market conditions, the Envato/Shutterstock acquisition, and the industry-wide shift to SaaS platforms to understand what's really happening with the #1 real estate WordPress theme on ThemeForest.

A Data-Driven Analysis of Houzez Search Trends, Real Estate Market Cycles, the SaaS Revolution, and What Really Happened

Why This Houzez Review Matters

With over 54,000 sales on ThemeForest, the Houzez real estate theme has established itself as a dominant player in the real estate WordPress theme market.

But sales numbers only tell part of the story

What are people actually searching for? Where is the interest coming from? Is the market growing or contracting? Why are major real estate markets absent from the top search regions? And how do real estate market cycles, platform acquisitions, and the rise of SaaS solutions affect a WordPress real estate theme business?

This Houzez Theme Trends Review digs into the data that most buyers never see—the search trends, geographic patterns, keyword signals, market conditions, and industry shifts that reveal the true state of the Houzez theme market in 2026.

Whether you're considering purchasing the Houzez WordPress theme, already using it, or evaluating real estate WordPress theme alternatives, this analysis provides insights you won't find in marketing materials.

The 5-Year Trend: Following the Real Estate Market

Looking at Google Trends data for "Houzez" over the past five years reveals a pattern that mirrors the global real estate market itself. Anyone researching whether to buy the Houzez theme should understand these market dynamics.

2021: Building Momentum

Search interest for the Houzez real estate theme hovered in the 25-50 range. The Houzez WordPress theme was established and growing, benefiting from:

- Post-pandemic digital transformation in real estate

- Low interest rates were fueling housing demand

- Agents and agencies are rushing to establish an online presence.

2022: Peak—But Why?

Mid-2022 marked the peak—search interest for the Houzez theme hit 100 (the maximum on Google's relative scale).

This wasn't just the Houzez real estate WordPress theme peak. It was the peak of the global real estate boom.

Consider what was happening in real estate markets worldwide in early-to-mid 2022:

- Housing prices at all-time highs

- Record transaction volumes

- Historic low interest rates are driving a buying frenzy.

- Every agent and agency needed a website—immediately.

- Real estate tech investment is surging.

- New brokerages are constantly launched.

When real estate booms, real estate WordPress themes boom.

The Houzez WordPress theme didn't peak because of superior marketing or product improvements. It peaked because the real estate market peaked. Every new agency, every expanding brokerage, and every agent going independent needed a website. The Houzez real estate theme was there to capture that demand.

2023-2024: The Cooling Period

Then the market shifted:

- Interest rates rose sharply (2022-2023)

- Housing prices plateaued or declined

- Transaction volumes dropped significantly

- Fewer new agencies are launching.

- Existing agencies are cutting costs and not investing in new websites.

Search interest for the Houzez theme declined from its peak but remained in the 50-90 range—still substantial, but no longer growing.

When the real estate market contracts, demand for real estate WordPress themes declines.

Late 2024: A Direct Statement

In October 2024, Waqas Riaz—co-founder and developer of Houzez theme—made a direct statement about the business situation:

"Houzez Ssales had declined and he was having to pay the team out of his personal portion of the sales."

He also stated that Envato membership had hurt Houzez sales.

This wasn't speculation. This statement reflects the Houzez co-founder's acknowledgment of financial pressure coming from various sources.

The Google Trends data corroborates this: Mortgage interest had declined significantly from the 2022 peak, and the real estate market was in a prolonged soft period with high interest rates suppressing transaction volume.

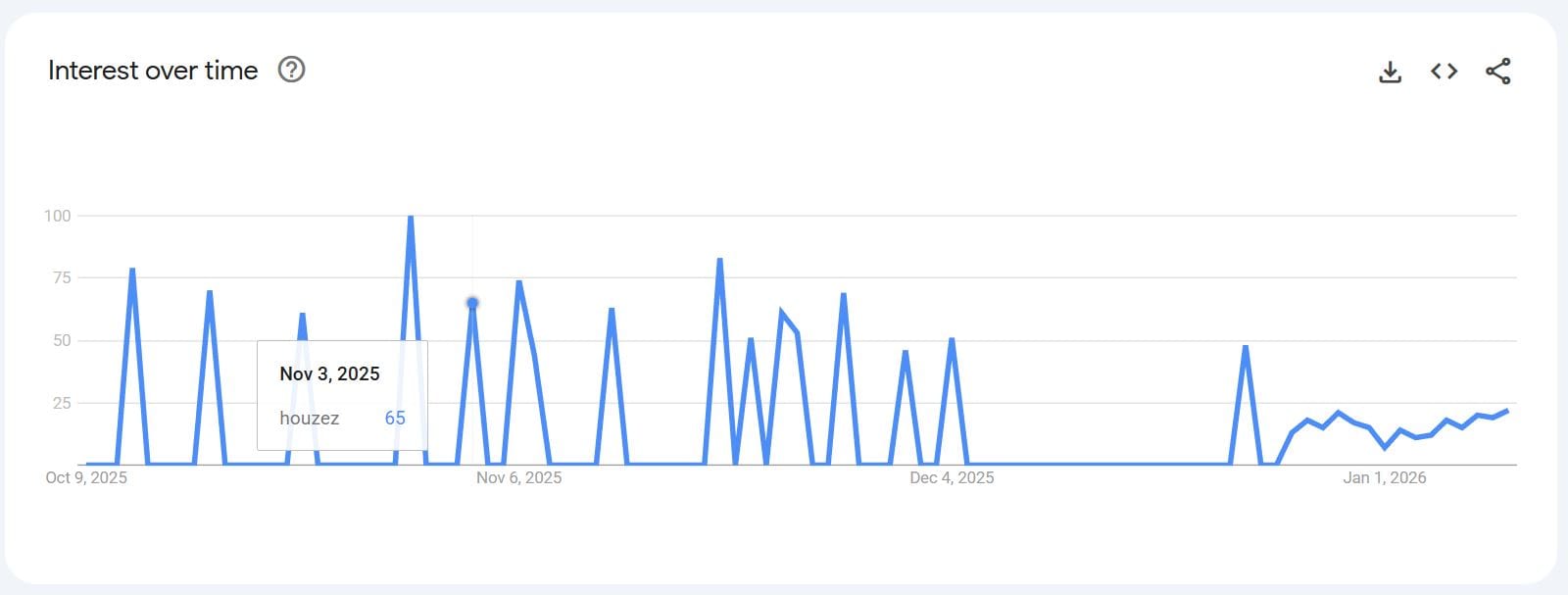

2025: The Houzez Contradiction

This is where the data becomes fascinating.

2025 was Houzez's most productive development year ever:

- 28 releases (a record)

- Major v4.0.0 Bootstrap 5.3 rebuild in June

- 9 releases in June alone

- Continuous updates through December

- New CRM product development

Yet despite this record development activity, search interest continued declining and then fell sharply in late 2025.

More updates didn't equal more interest. The market responded to factors beyond release frequency.

Late 2025: The Cliff

The sharpest decline in five years occurred in December 2025. Interest dropped from a consistent 70-90 range to approximately 25-30 — a 60-70% decline in a single month.

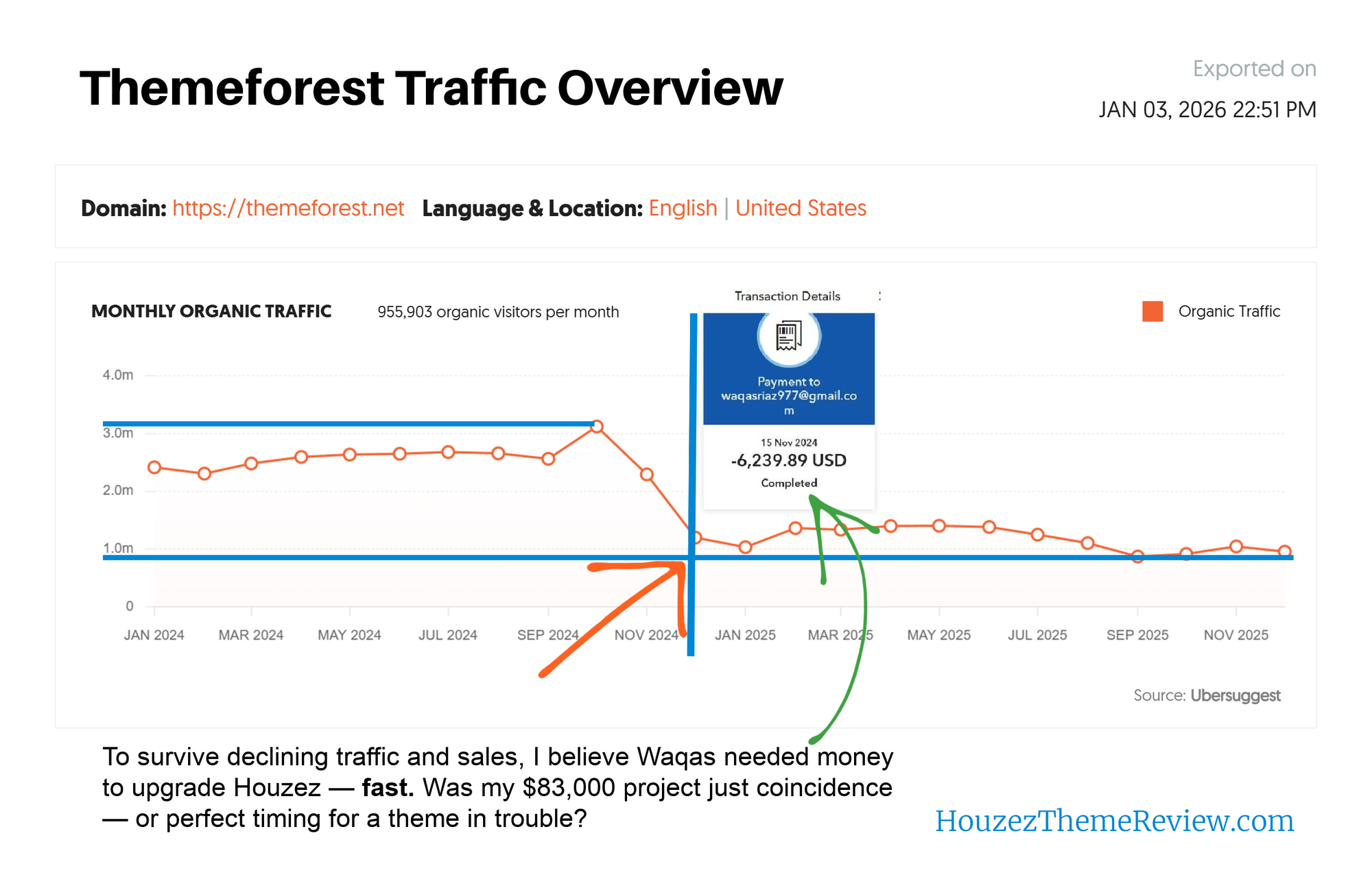

Envato/Shutterstock Acquisition: A Market Shift

Regarding Houzez, you need to understand the implications to understand what happened to the Themeforest marketplace.

The platform where Houzez is sold (ThemeForest) is owned by Envato, which was acquired by Shutterstock — a company that has lost 73% of its value since 2021. The entire ecosystem Waqas depends on is in freefall.

July 2024: Shutterstock Acquires Envato

| Detail | Information |

|---|---|

| Buyer | Shutterstock, Inc. (NYSE: SSTK) |

| Price | $245-285 million USD |

| Announced | May 2, 2024 |

| Completed | July 22, 2024 |

| Strategic Focus | Envato Elements subscription model |

Shutterstock didn't buy Envato for ThemeForest. They bought it for Envato Elements—the unlimited subscription service.

ThemeForest’s SEO traffic drop looks like a Google visibility problem, not a brand-interest collapse—Ubersuggest shows ~955,903 US organic visits/month after a sharp late‑2024 cliff that lines up with a big reduction in Top‑10 rankings.

For 2026, a partial recovery is possible only if those Top‑10 keyword counts start climbing for a few straight months; otherwise, the most likely outcome is stabilizing around ~1M/month, not snapping back to 2024 highs.

From the acquisition announcement:

"Complements Shutterstock's existing offering with Envato Elements, a leading unlimited multi-asset subscription offering."

What This Means for Theme Authors

The old model (ThemeForest):

- The customer pays $79 for a Houzez license (the price increased from $69 to offset declining volume).

- Author receives percentage of each sale

- Lifetime license—one sale per customer, forever

- No recurring revenue

The new model (Envato Elements):

Envato Elements is a subscription (“from $16.50/month”) that allows unlimited downloads of items in the Elements library, subject to Fair Use rules.

Envato Market/ThemeForest items are separate and must be purchased individually.

Authors on Elements are compensated through Envato’s Subscriber Share model, which distributes a portion of each subscriber’s net revenue to the authors of the items that subscriber used, based on usage (item points/importance), rather than a simple equal split among all authors.

The Houzez One‑Time License Problem

Houzez is typically purchased once per website under Envato Market’s ThemeForest licensing model. The license is ongoing for a single end product (one “single application”), which means the buyer can keep using that theme on that one site, and Houzez includes future updates (support is included for 6 months, with an option to extend).

But let’s be precise about what ThemeForest’s model actually is for Houzez:

| License Type | Price | What you’re allowed to do (plain English) |

|---|---|---|

| Regular License | $79 | Use for one client or yourself in one end product (one site). End users are not charged for access to the end product (you can still charge your client for your services). ThemeForest+2ThemeForest+2 |

| Extended License | $2,399 | Still one client / one end product, but the end product may be sold / end users can be charged. ThemeForest+1 |

Bottom line: One license = one website/end product. If a developer builds 10 separate client websites, they should purchase 10 licenses (one per site).

Support (per Envato/ThemeForest):

| Period | Cost |

|---|---|

| First 6 months | Included with $79 purchase |

| Extend to 12 months (at purchase) | +$25.13 |

| Renew 6 months (after expiry) | $58.63 |

What support includes:

- Questions about features and functionality

- Technical questions about the item

- Bug reports and defects

- Help with included third-party assets

What support does NOT include:

- Customization

- Installation

- Hosting or server issues

- Modifications beyond original features

So here's the contradiction: If support officially expires after 6 months, and customization/installation isn't included... why is Waqas drowning in support requests?

The answer likely involves some combination of:

- Users demand support after expiration — They paid $79 "forever" and expect help forever, even though support technically expires

- Users ask for customization/installation — Not covered by Envato policy, but users expect it anyway

- Documentation gaps — The 260 monthly "houzez documentation" searches suggest users can't find answers

- License violation by developers — Developers buy ONE license, build 10+ client sites, then expect support for all of them

Consider the math if developers are violating license terms:

- Developer buys: 1 license ($79)

- Developer builds: 10 client sites

- Support requests: 10 clients asking questions

- Revenue per supported site: $7.90

This would explain why Waqas faces a crushing support burden despite 54,000+ sales—the actual number of installations may be 5-10x higher than licenses sold.

The Support Crisis

Waqas stated that support is very high, demanding, and costly.

The keyword data confirms this:

- 260 monthly searches for "houzez documentation"

- Only 20 monthly searches to buy

- 13:1 ratio of support-seeking to purchase intent

Compare the Houzez theme model to SaaS:

| Factor | Houzez Theme | SaaS (e.g., kvCORE) |

|---|---|---|

| Purchase price | $79 one-time | $500/month |

| Support included | 6 months | Ongoing |

| Support renewal | $58.63/6 months (optional) | Included in subscription |

| Annual revenue per customer | $79 (year 1), potentially $0 after | $6,000/year recurring |

| Customer expectation | "I paid, help me forever" | "I'm paying, help me now" |

The fundamental problem: Users who paid $79 expect lifetime support, but Envato's policy only guarantees 6 months.

When support expires, users face a choice:

- Pay $58.63 to renew (many don't)

- Search for "houzez documentation" instead (260/month do this)

- Demand help anyway through comments, forums, or direct contact

This is why Waqas had to increase the price (from $69 to $79). Volume was declining, but support obligations weren't. The only lever was price.

Waqas Acknowledged This

When explaining his financial situation in October 2024, Waqas specifically mentioned:

- Envato membership had hurt Houzez sales

- Support is very high, demanding, and costly

- They only sell Houzez one-time per lifetime license

The data supports this. Envato Elements launched years ago, but the Shutterstock acquisition in July 2024 signaled a strategic doubling-down on the subscription model. ThemeForest's individual sales marketplace is no longer the priority—subscriptions are.

For a theme author dependent on one-time $79 sales while carrying lifetime support obligations for 54,000+ customers, this is an existential crisis.

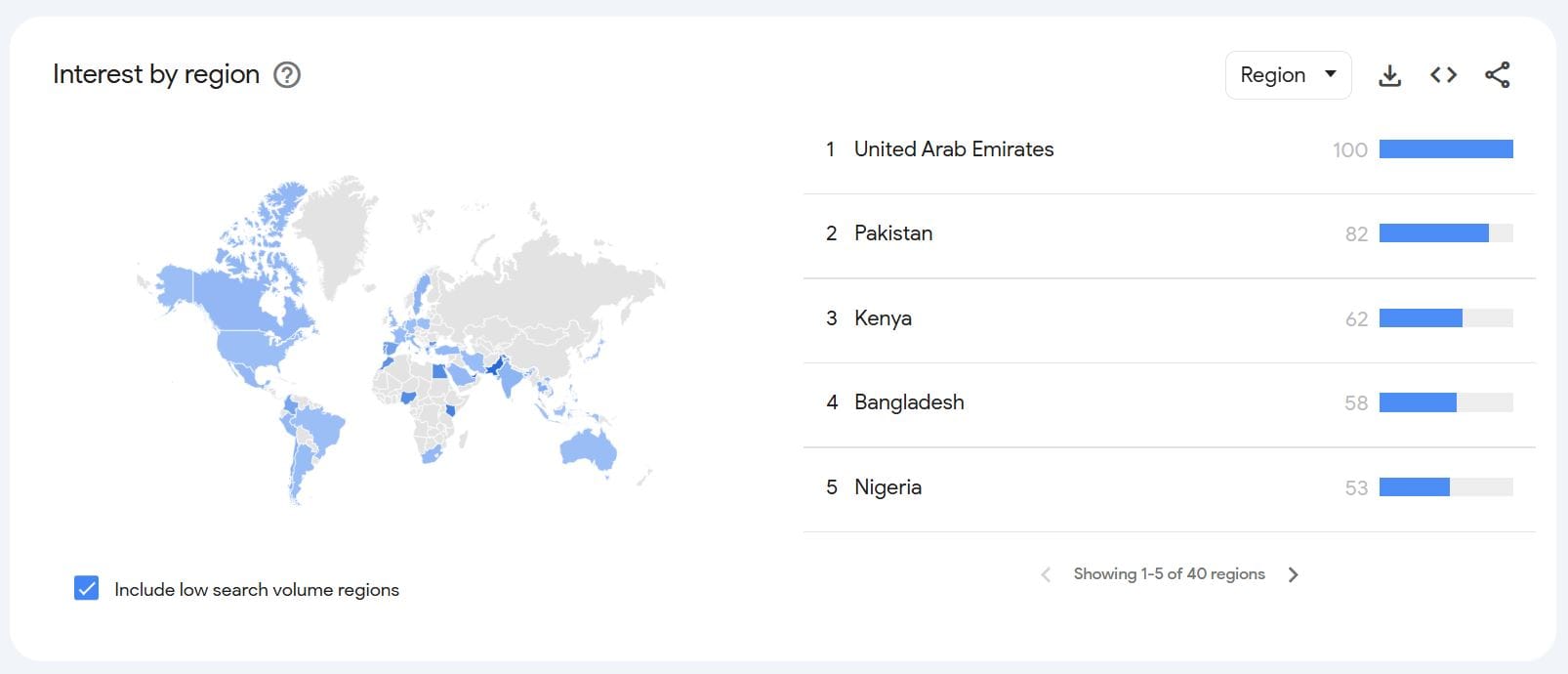

The SaaS Revolution: Why Major Markets Aren't Searching for Houzez WordPress Theme

This Houzez review must address the elephant in the room: Why aren't the United States, the United Kingdom, Canada, and Australia in the top 5 search regions for this real estate WordPress theme?

These are the world's largest, most active real estate markets. They have massive WordPress adoption. They have agencies with budgets for premium tools.

Yet they don't appear in the top search regions for Houzez.

The answer: They've moved to SaaS.

The All-in-One SaaS Platforms

Professional real estate agencies in major markets are increasingly choosing integrated SaaS platforms over WordPress themes:

| Platform | What It Includes | Typical Price |

|---|---|---|

| BoldTrail (kvCORE) | Website + CRM + IDX + Lead Gen + Marketing Automation + Transaction Management | $500/month + $1,000 setup |

| Luxury Presence | Premium branded website + CRM + Marketing + SEO | Custom pricing (premium tier) |

| Real Geeks | Website + CRM + Lead Gen | Budget-friendly tier |

| Follow Up Boss | CRM + Marketing Automation | Popular with teams |

What SaaS Platforms Offer That the Houzez WordPress Theme Doesn't

| Feature | Houzez Theme (WordPress) | SaaS Platform (e.g., kvCORE) |

|---|---|---|

| Website | Yes (requires setup) | Yes (included, pre-configured) |

| Hosting | You find and pay separately | Included |

| IDX/MLS Integration | Plugin required (extra cost) | Built-in |

| CRM | Not included | Built-in with AI |

| Lead Generation Tools | Limited | Comprehensive |

| Marketing Automation | Not included | Built-in |

| Transaction Management | Not included | Built-in |

| Updates | Manual (you update WordPress + theme) | Automatic |

| Support | Theme support only | Full platform support |

| Mobile App | Not included | Often included |

The Professional Agency's Choice: Houzez Real Estate Theme vs SaaS

Option A: Buy Houzez Theme + WordPress Stack

- Buy Houzez WordPress theme: $79

- Find hosting: $20-100/month

- Install and configure WordPress

- Configure Houzez theme settings

- Find and purchase IDX plugin: $50-100/month

- Find and configure CRM: $50-500/month

- Integrate everything yourself

- Manage updates manually

- Troubleshoot compatibility issues

Option B: kvCORE/BoldTrail SaaS

- Pay $500/month

- Everything works together out of the box

- One vendor, one support line

- Automatic updates

- Focus on selling real estate, not managing technology

For a professional agency billing millions in commissions, $500/month for an integrated solution is trivial. The time saved on technology management alone justifies the cost over the Houzez real estate WordPress theme approach.

The Market Has Bifurcated

Who still searches to buy Houzez theme:

- Solo agents on tight budgets

- Developers who build sites for clients

- International markets with less SaaS penetration

- Agencies in countries where $79 is significant

Who has moved to SaaS:

- Professional agencies in major markets (US, UK, Canada, Australia)

- Teams and brokerages wanting integrated solutions

- Anyone prioritizing time over upfront cost savings

This explains the Houzez WordPress theme geographic data perfectly.

The BetterCloud Prediction

According to BetterCloud research cited by industry analysts:

"By 2025, 85% of business apps will be SaaS-based."

Real estate is not immune to this trend. The question isn't whether the industry moves to SaaS—it's how fast.

Geographic Analysis: The Developer Market

With major Western markets moving to SaaS, who IS searching for Houzez?

Top 5 Countries (Past 5 Years)

| Rank | Country | Interest Score |

|---|---|---|

| 1 | Benin | 100 |

| 2 | Montenegro | 90 |

| 3 | Cyprus | 90 |

| 4 | Albania | 60 |

| 5 | Pakistan | 60 |

What's Missing?

- United States

- United Kingdom

- Canada

- Australia

- Germany

- France

What This Geographic Data Reveals

The Houzez market is not primarily Western real estate agencies. It's:

- Developers and resellers — Purchasing themes to build client sites

- Smaller/emerging markets — Where SaaS hasn't penetrated

- Price-sensitive buyers — Where $79 is a significant investment requiring research

- The development origin is Pakistan, where Waqas and the Houzez team operate out of Lahore

Pakistan ranking #5 is particularly notable. This is where the theme is developed. High search interest from the development origin suggests:

- Internal searches

- Competitor research

- Developer community activity

- Support-seeking by local users

This is not the profile of a product primarily serving Western real estate professionals.

The Timeline: Following the Money

This Houzez Theme Trends Review must address a significant timeline that intersects with the market data.

October 2024: The Starting Point

- Real estate market: Soft (high rates, low transaction volume)

- Houzez interest: Declined from 2022 peak

- Envato: Just acquired by Shutterstock (July 2024)

- Elements subscription: Cannibalizing individual theme sales

- Waqas's stated situation: "Sales declined, paying team from personal funds"

- What happened: I began paying $6,240 USD monthly for a custom development project

October 2024 - November 2025: The Payment Period

Over 14 months, I paid $83,000 USD to Waqas Riaz for the development of ESP Marketplace—a B2B platform completely unrelated to Houzez his Themeforest theme.

During this exact period:

- Houzez had its most productive development year ever

- 28 releases shipped

- Major v4.0.0 Bootstrap 5.3 rebuild completed

- Houzez CRM development began

The Question This Raises

| October 2024 Situation | What Happened Next |

|---|---|

| "Sales declined" | Record Houzez development year |

| "Envato membership hurt sales" | New products launched |

| "Paying team from personal funds" | $83,000 flowed in over 14 months |

| Financial pressure acknowledged | 28 releases shipped, plus new CRM |

If Waqas was struggling to pay developers in October 2024, how did Houzez suddenly have its most productive year ever?

The GitHub forensic analysis shows that the same developers—particularly shanijahania, who contributed approximately 50% of the ESP Marketplace commits—were working on both my project and Houzez products.

The $83,000 I paid entered an operation that was simultaneously developing Houzez.

I cannot prove that my money directly funded the Houzez v4.0.0 rebuild. But the timeline is notable:

- Cash flow was tight before my payments started

- My payments provided steady monthly income

- Houzez had recorded development output during my payment period.

- My project was never completed or deployed

The 12-Month View: A Closer Analysis

Zooming into just the past 12 months provides more granular insight:

| Period | Interest Level | What Was Happening |

|---|---|---|

| January - May 2025 | 50-70 | Steady baseline |

| June 2025 | 70-100 | v4.0.0 release, 9 updates in one month |

| July - October 2025 | 70-90 | Continued high activity |

| November 2025 | ~75 | My final payment, then decline begins |

| December 2025 | 25-30 | Sharp 60-70% drop |

The June-October peak aligns with Houzez's intensive development period. The v4.0.0 release and subsequent updates generated buzz.

But November marked my final payment. And December marked the sharpest decline in five years.

Correlation isn't causation. But the timing is documented.

Keyword Analysis: What People Actually Search About Houzez

Beyond the brand term "Houzez," keyword research reveals what potential buyers and current users are looking for when they search for this real estate WordPress theme.

Houzez-Specific Keywords

| Keyword | Monthly Searches | CPC | SEO Difficulty |

|---|---|---|---|

| houzez | 3,600 | $0.85 | — |

| houzez theme | 2,400 | $0.96 | — |

| houzez wordpress theme | 320 | $0.91 | — |

| houzez documentation | 260 | $0.26 | — |

| houzez theme documentation | 260 | $0.26 | 20 |

| houzez real estate wordpress theme | 210 | $1.03 | — |

| houzez crm | 110 | $5.11 | — |

| houzez real estate theme | 70 | $1.36 | — |

| buy houzez theme | 10 | $1.00 | 94 |

| buy houzez | 10 | $0.00 | 100 |

The Houzez Documentation Problem

One number demands attention: 260 monthly searches for "houzez documentation"

This is a critical signal for anyone considering the Houzez WordPress theme.

Compare this to purchase intent:

- "buy houzez theme": 10 searches/month

- "buy houzez": 10 searches/month

- Total purchase intent: 20 searches/month

The Key Finding: For every 1 person searching to buy Houzez, 13 people are searching for documentation. This 13:1 ratio tells the real story of the Houzez theme market.

This 13:1 ratio of support searches to purchase searches reveals:

- Current users struggle with implementation

- The theme has a significant learning curve

- Documentation may not be easily discoverable or sufficient

- Support burden far exceeds new buyer interest

Buy Houzez Theme: Purchase Intent Is Remarkably Low

Only 20 people per month search with clear intent to buy Houzez theme. For a theme with 54,000+ sales, this reveals something critical:

The Houzez real estate theme doesn't have strong brand-driven purchases.

People aren't searching "buy houzez theme" or "buy houzez" — they're finding it through generic searches like:

| Generic Keyword | Monthly Searches |

|---|---|

| real estate wordpress theme | 480 |

| realtor wordpress theme | 480 |

| real estate theme | 90 |

| themeforest real estate | 170 |

Buyers are comparison shopping for a real estate WordPress theme and encountering Houzez, not seeking the Houzez theme specifically.

The Houzez CRM Market Comparison

Related topic data shows interest in CRM alongside Houzez theme searches:

| Keyword | Monthly Searches | CPC |

|---|---|---|

| real estate crm | 5,400 | $41.68 |

| houzez crm | 110 | $5.11 |

The generic CRM market is 49x larger than Houzez CRM searches. And CPCs are 8x higher ($41 vs $5), indicating the generic market is far more commercially competitive.

The comparison matters because the Houzez real estate theme developers are launching CRM products. But brand awareness for any Houzez CRM is minimal—110 searches per month. Meanwhile, platforms like kvCORE/BoldTrail dominate the professional CRM space with tens of thousands of searches per month.

Market Context: The Competitive Landscape

This Houzez Theme Trends Review must place Houzez within its full competitive context.

The Four-Way Squeeze

Houzez faces pressure from four directions simultaneously:

1. Real Estate Market Decline

- Peak was 2022

- High interest rates suppressed transactions 2023-2024

- Fewer new agencies = fewer theme buyers

2. Envato Elements Cannibalization

- Subscription model competes with individual sales

- Shutterstock acquisition doubled down on subscriptions

- $16.50/month unlimited vs $79 one-time purchase

3. SaaS Platform Competition

- Major markets moved to all-in-one solutions

- kvCORE, Luxury Presence, Real Geeks capture professional agencies

- WordPress themes can't compete on convenience

4. The Support Model Crisis

- Support officially expires after 6 months

- Users expect lifetime help for $79 one-time payment

- Likely license violations: 1 license used for multiple client sites

- 13:1 ratio of support searches to purchase searches

- Support burden may exceed actual license revenue

The Remaining Market

Who's left buying WordPress real estate themes?

- Budget-conscious solo agents—can't afford $500/month SaaS

- Developers/agencies building client sites — Buy once, use many times

- International markets—SaaS platforms haven't penetrated, $79 is significant

- DIY enthusiasts — Prefer WordPress control over SaaS convenience

This is not a growth market. It's a maintenance market—serving buyers who haven't yet moved to alternatives.

Inside the ThemeForest Business Model: How Houzez Really Makes (and Loses) Money

To truly understand the pressures facing the Houzez WordPress theme, you need to understand how ThemeForest's licensing and support model actually works. This section provides a detailed look at the economics that most theme buyers never consider—and that help explain everything about the Houzez theme's situation.

The Two License Types

ThemeForest offers two license types for themes like Houzez:

Regular License: $79

The Regular License permits use of the Houzez theme for one project where end users are not charged. This is the license 99%+ of Houzez buyers purchase.

What does "end users are not charged" mean? It means visitors to the website use it for free. A real estate agency website where people browse listings, contact agents, and search properties—but don't pay anything to use the website itself—qualifies for the Regular License.

Examples of Regular License usage:

- A Century 21 franchise website where visitors browse listings for free

- A solo real estate agent's portfolio and contact site

- A property developer showcasing new construction projects

- A brokerage website with IDX/MLS integration

In all these cases, the website is a marketing tool. The agency or agent makes money from commissions when properties sell—not from charging website visitors. The website itself generates no direct revenue from users.

Extended License: $2,399

The Extended License is required when end users pay to use the website. This is rare for real estate themes.

Examples requiring an Extended License:

- A property portal charging agents monthly subscription fees to list properties

- A Zillow-style marketplace taking transaction fees

- A membership site where buyers pay for premium access to listings

- A SaaS platform built on top of Houzez where users pay recurring fees

The Extended License costs 30 times more than the Regular License because, in theory, the buyer is building a revenue-generating platform on top of the theme.

Why Extended License Sales Are Rare

The reality is that almost nobody buys the Houzez real estate WordPress theme to build a paid platform. They buy it to build agency websites, portfolio sites, and client projects. The $2,399 Extended License represents a tiny fraction of total sales.

If Houzez has 54,000+ lifetime sales, perhaps 1% or fewer are Extended Licenses. The overwhelming majority are $79 Regular Licenses for standard real estate websites.

What $79 Actually Buys

Here's what the Houzez theme buyer receives for their $79 Regular License:

| Included | Duration |

|---|---|

| License for ONE project | Lifetime |

| All future theme updates | Lifetime (free forever) |

| Support from favethemes | 6 months only |

This is where the business model becomes problematic.

Lifetime updates are included. When you buy Houzez for $79, you receive every future update—forever. The 28 releases shipped in 2025? Free to all existing license holders. The v4.0.0 Bootstrap 5.3 rebuild that required significant development resources? Free. Every bug fix, security patch, WordPress compatibility update, and new feature for the next decade? Free.

But support expires after 6 months. The only ongoing revenue opportunity from existing customers is support extensions and renewals:

| Support Option | Price |

|---|---|

| Initial support (included) | 6 months |

| Extend to 12 months at purchase | +$25.13 |

| Renew expired support | $58.63 for 6 months |

This creates a structural problem: the most expensive part of running a theme business—ongoing development, updates, compatibility maintenance—generates zero recurring revenue. The only potential recurring revenue comes from support renewals, which most customers avoid.

Why the 13:1 Documentation Ratio Makes Sense Now

Recall the keyword data: 260 monthly searches for "houzez documentation" versus only 20 searches for "buy houzez theme." That's 13 people searching for documentation help for every 1 person searching to purchase.

With the business model context, this ratio tells a clear story.

When a Houzez theme user has a problem after 6 months, they face a choice:

Option A: Pay $58.63 to renew support, submit a ticket, wait for a response.

Option B: Search Google for "houzez documentation" and find the answer for free

Most people choose Option B. The $58.63 support renewal feels expensive for what might be a single question. And searching is instant—no ticket submission, no waiting for a response.

The 260 monthly documentation searches likely represent:

- Users with expired support — Their 6 months ran out, they won't pay $58.63 to renew, so they search for answers instead

- Developers building multiple client sites— They might own one license but build many sites. Paying $58.63 per client project for support isn't viable, so they rely on documentation

- Users who prefer self-service — Even with active support, some people prefer finding answers themselves rather than waiting for ticket responses

- Users frustrated with existing documentation — Searching for explanations the official docs don't provide clearly

The business model creates the documentation search volume. If support were included for longer, or if renewal were cheaper, fewer people would resort to Google searches. But at $58.63 for 6 months of support—nearly 75% of the original theme purchase price—most users simply search instead.

The Fundamental Economics Problem

The Houzez theme's business model has a structural flaw that becomes more severe with each sale:

Revenue is one-time. Costs are perpetual.

Consider what happens when someone buys Houzez:

| Year | Customer Pays | Houzez Must Provide |

|---|---|---|

| Year 1 | $79 | Updates + 6 months support |

| Year 2 | $0 | Updates (WordPress compatibility, bugs, features) |

| Year 3 | $0 | Updates |

| Year 4 | $0 | Updates |

| Year 5 | $0 | Updates |

| Year 10 | $0 | Updates |

The customer pays once. Houzez is required to maintain, update, and improve the theme indefinitely.

Every sale adds a perpetual obligation funded by a one-time payment.

With 54,000+ licenses sold, Houzez has 54,000+ users expecting:

- Compatibility with new WordPress versions (WordPress releases major updates multiple times per year)

- Compatibility with PHP updates (hosting requirements evolve)

- Compatibility with popular plugins (Elementor, WPBakery, IDX plugins)

- Bug fixes when issues are discovered

- Security patches when vulnerabilities emerge

- New features to stay competitive with other themes

The 28 releases shipped in 2025 — Houzez's most productive year ever—generated $0 from the 54,000+ existing customers. All that development work was given away free to everyone who ever purchased a license.

The only way to fund ongoing development is new sales. But new sales are declining (real estate market down, SaaS competition, Envato Elements cannibalization). And each new sale adds another perpetual obligation.

This is why Waqas stated he was "paying the team out of his personal portion of the sales." The math doesn't work. Revenue is flat or declining while obligations grow with every license sold.

Why Waqas Wants a Subscription Model

Understanding the economics makes Waqas's stated desire for a subscription model completely logical.

Current Model (ThemeForest):

54,000 customers × $79 one-time = ~$4.3 million lifetime revenue

Minus Envato's cut (37-55%) = ~$2-2.7 million to Houzez

Spread over 10+ years = ~$200-270K per year

To fund: Perpetual updates for 54,000+ users

Subscription Model (What Waqas Wants):

If 10% of users subscribed at $79/year:

5,400 subscribers × $79/year = $426,600 annual recurring revenue

Predictable, renewable, aligned with ongoing costs

A Houzez subscription model would:

- Provide recurring revenue to fund ongoing development

- Align costs with revenue (yearly subscription funds updates)

- Create predictable cash flow instead of declining one-time sales

- Allow the business to scale sustainably

- Protect Waqas's high-paying clients

But Houzez is locked into ThemeForest's model. They can't unilaterally switch to subscriptions. And their 54,000+ existing customers have lifetime update rights that can't be revoked.

The Support Revenue Trap

Could Houzez make up the revenue shortfall through support renewals?

The math on support revenue potential:

| Scenario | Calculation | Annual Revenue |

|---|---|---|

| If 10% of users renewed support yearly | 5,400 × $58.63 | $316,602 |

| If 5% of users renewed support yearly | 2,700 × $58.63 | $158,301 |

| If 1% of users renewed support yearly | 540 × $58.63 | $31,660 |

The problem: support renewal rates are likely very low. At $58.63 for 6 months (nearly 75% of the original purchase price), most users simply search Google or AI instead. The 260 monthly houzez documentation searches suggest self-service is the default behavior.

And even if support renewal rates were high, providing support for thousands of users is expensive. Support requires staff, time, ticket systems, and expertise. High support volume with $58.63 renewals might not even be profitable.

This is why Waqas stated that support is "very high, demanding, and costly." The support requests come whether or not people pay for renewals. Users expect help. They post in forums, leave negative reviews, and complain publicly if ignored. The support burden exists regardless of support revenue.

The Houzez Extended License Mirage

Some might wonder: what about Extended License sales at $2,399?

While the Extended License price for Houzez is attractive, the market for it is tiny. Almost no one buys a real estate WordPress theme to build a paid platform. They buy it to build agency websites.

If 1% of Houzez's 54,000+ sales were Extended Licenses:

- 540 Extended Licenses × $2,399 = ~$1.3 million

- Minus Envato's cut = ~$650K-850K

- Spread over 10+ years = ~$65-85K per year

Not insignificant, but not enough to change the fundamental economics.

The Complete Picture

The Houzez theme business model, like many ThemeForest themes, is structurally challenged:

Revenue streams:

- New Regular License sales ($79) —Declining

- New Extended License sales ($2,399) —Rare

- Support renewals ($58.63) —Low uptake (people search instead)

- Support extensions ($25.13) —Low uptake

Cost obligations:

- Perpetual updates for 54,000+ users

- WordPress compatibility maintenance

- PHP compatibility maintenance

- Plugin compatibility maintenance

- Bug fixes and security patches

- Documentation (free, but expected)

- Support (whether paid or not, complaints come)

The result:

- Each sale adds permanent costs

- Revenue doesn't recur

- The more successful the theme, the worse the economics

- Cash flow pressure is constant

In my opinion, this is why my USD $83,000 over 14 months was so significant. It represented steady, predictable monthly income—exactly what the Houzez business model cannot generate on its own. $6,240 per month is more predictable revenue than the feast-or-famine of ThemeForest sales.

And this is why, during my payment period, Houzez had its most productive development year ever. The cash flow was there to fund it—coming from me.

Rising Related Queries: Market Direction

Google Trends shows which related queries are growing:

Rising Queries

| Query | Growth |

|---|---|

| buy houzez theme | Breakout |

| buy houzez | +350% |

| elementor | +250% |

| houzez theme documentation | +50% |

What Rising Queries Indicate

Elementor Integration (+250%)

The growth in Elementor-related searches indicates users want page builder compatibility. This is a key decision factor for buyers.

Documentation (+50%)

Growing documentation searches reinforce the support burden signal. As more people use Houzez, more people need help.

"Buy" Queries (Breakout, +350%)

The growth percentages sound impressive, but remember the base: growing from 10 to 35 searches is "+350%," but it is still only 35 people monthly actively searching to purchase Houzez.

2026 Housing Market Outlook: Will Recovery Save tHouzez Theme?

The National Association of Realtors is forecasting a 14% increase in home sales for 2026 — the first meaningful uptick after three years of stagnation. Mortgage rates are expected to drop from 7% to around 6%, and for the first time since the Great Recession, incomes are projected to rise faster than home prices.

This sounds like good news for real estate technology providers. More transactions mean more active agents, more website needs, and more potential customers.

But here's the reality check: even a 14% increase brings sales back to approximately 4.2-4.5 million—still below pre-pandemic norms. The market is experiencing what Redfin calls "The Great Housing Reset"—a slow, multi-year recovery, not a boom.

What 2026 Won't Fix for Houzez

The structural challenges facing the Houzez WordPress theme do not disappear even with an improved housing recovery.

SaaS competition remains: Professional agencies in the US, UK, Canada, and Australia have already migrated to all-in-one platforms like kvCORE and Follow Up Boss. A modest market improvement won't reverse that shift.

Envato Elements cannibalization continues: The $16.50/month subscription model still competes against $79 one-time purchases.

54,000+ lifetime license obligations persist: Every Houzez customer still expects free updates forever, regardless of market conditions.

Support economics unchanged: The 13:1 ratio of documentation searches to purchase intent reflects expired support renewals, not market cycles.

A rising tide lifts all boats—but some boats have structural holes. The 2026 housing recovery may slow Houzez's decline, but it won't address the fundamental business model challenges documented throughout this analysis.

What This Houzez Theme Trends Review Reveals

Finding 1: The Real Estate Market Drives Everything

Houzez reached its highest popularity in 2022, coinciding with the peak of the real estate market that year. The theme's fortunes are tied to the broader market, not product quality or marketing.

When real estate booms, Houzez booms. When real estate contracts, Houzez contracts.

Finding 2: Envato Elements Cannibalized Sales

The subscription model directly competes with individual theme purchases. Waqas acknowledged this. The Shutterstock acquisition confirmed Envato's strategic focus on subscriptions over marketplace sales.

Finding 3: Major Markets Moved to SaaS

The US, UK, Canada, and Australia aren't in Houzez's top search regions because professional agencies in those markets have moved to all-in-one SaaS platforms like kvCORE/BoldTrail and Luxury Presence.

WordPress themes can't compete with integrated solutions in terms of convenience.

Finding 4: Financial Pressure Was Real

Waqas Riaz directly stated in October 2024 that sales had declined, Envato membership hurt sales, and he was paying the team from personal funds. The Google Trends data corroborates declining interest from the 2022 peak.

Finding 5: Record Development During Cash Infusion

The same period that saw $83,000 flow into Waqas's operation (October 2024 - November 2025) also saw record Houzez development—28 releases, the v4.0.0 rebuild, and new CRM products.

The connection between incoming cash and outgoing development is notable.

Finding 6: Updates Don't Drive Interest

Despite 28 releases in 2025—more than any other year—search interest declined. Development activity and market interest are disconnected.

Finding 7: The Market Is Developer-Centric

Geographic data shows top interest from Benin, Montenegro, Cyprus, Albania, and Pakistan—not major real estate markets. The buyer profile is developers and resellers, not Western real estate agencies.

Finding 8: Support Exceeds Sales Interest

With 13x more documentation searches than purchase searches, current users need help at a rate that far exceeds new buyer interest.

Finding 9: Brand Loyalty Is Limited

Only 20 monthly searches show direct purchase intent. Most buyers find Houzez through generic "real estate wordpress theme" searches, not brand recognition.

Finding 10: The December 2025 Drop Is Significant

A 60-70% decline in a single month exceeds normal seasonal patterns. This occurred the month after my final payment and the month my documentation site began ranking.

Implications for Different Audiences

For Potential Houzez Theme Buyers

- Understand that the Houzez real estate theme's fortunes follow the real estate market

- Consider whether WordPress themes still make sense vs. SaaS alternatives

- Research extensively before purchasing — the 13:1 Houzez documentation ratio indicates a learning curve

- Evaluate your technical capabilities for WordPress management

- Consider whether your market aligns with the primary Houzez theme user base

For Current Houzez WordPress Theme Users

- Houzez documentation demand is high — you're not alone if you're struggling

- The Houzez theme is mature and tied to a cyclical market

- Consider how dependent your business is on continued development

- Evaluate SaaS alternatives for your next platform decision

For Developers/Agencies Using Houzez Real Estate Theme

- The geographic data suggests a developer-heavy market for Houzez theme

- Competition for client work may be significant

- Brand awareness with end clients is limited

- Consider whether building on real estate WordPress themes remains viable long-term

For the WordPress Real Estate Theme Community

- Theme markets follow their vertical markets (real estate WordPress themes follow real estate)

- Subscription models (Envato Elements) are cannibalizing individual theme sales

- SaaS platforms are capturing professional users in major markets

- Support burden is a real cost that keyword data reveals

- Geographic patterns tell stories that ThemeForest sales numbers hide

Methodology

This Houzez Theme Trends Review used the following data sources:

- Google Trends: 5-year and 12-month worldwide data for "Houzez" and "Houzez theme"

- Keyword Research: Search volume, CPC, and difficulty data from Ubersuggest for Houzez WordPress theme keywords

- Geographic Data: Google Trends regional interest breakdown for Houzez real estate theme

- Related Queries: Rising and breakout query analysis including "buy houzez theme"

- Industry Research: Envato/Shutterstock acquisition documentation, SaaS platform analysis

- Direct Statements: Documented communications regarding business conditions

- Timeline Evidence: Payment records and development activity correlation

All search data represents search interest, not sales figures. Search interest indicates market attention and research behavior, which correlates with but doesn't equal purchasing of the Houzez real estate WordPress theme.

Conclusion

This Houzez Theme Trends Review reveals a real estate WordPress theme market under pressure from multiple directions.

The macro forces affecting the Houzez theme:

- Real estate market peaked in 2022 and hasn't recovered

- Envato Elements subscription cannibalizes individual Houzez theme sales

- Shutterstock acquisition prioritizes subscriptions over ThemeForest marketplace

- SaaS platforms captured professional users in major markets

- Real estate WordPress themes face existential competition from all-in-one solutions

- Lifetime license model creates perpetual support burden with no recurring revenue

The Houzez WordPress theme numbers tell a story:

- 3,600 monthly brand searches for Houzez theme (down from peak)

- 260 Houzez documentation searches (support burden)

- 20 buy Houzez theme searches (limited brand-driven sales)

- 60-70% decline in December 2025 (sharp downturn)

- 13:1 ratio of support searches to purchase searches

The Houzez theme geographic data raises questions:

- Top interest from Benin, Montenegro, Cyprus, Albania, Pakistan

- Major real estate markets (US, UK, Canada, Australia) not in top 5

- Professional agencies in those markets have moved to SaaS

The Houzez real estate theme timeline is notable:

- October 2024: "Sales declined, Envato hurt sales, paying team from personal funds"

- October 2024: My $83,000 payment period begins

- 2025: Record Houzez development (28 releases, v4.0.0 rebuild, new CRM)

- November 2025: My final payment

- December 2025: Sharp cliff in search interest

What Waqas told me was true:

- Sales had declined ✓

- Envato membership hurt Houzez sales ✓

- He was paying the team from personal funds ✓

- Support is very high, demanding, and costly ✓

- They only sell Houzez one time per lifetime license ✓

The business model crisis:

- Official support: 6 months included, then expires

- User expectation: "I paid $79, help me forever"

- Likely license violations: Developers using 1 license for multiple client sites

- Actual installations may be 5-10x higher than licenses sold

- Price increased from $69 to $79 to offset declining volume

- Support searches (260/month) dwarf purchase searches (20/month) by 13:1

What he didn't tell me:

- My $83,000 would fund his operation's recovery

- His developers would work on Houzez products during my payment period

- My project would never be completed while Houzez had its best development year ever

None of this means the Houzez WordPress theme is a bad product. With 54,000+ sales on ThemeForest, the Houzez real estate theme clearly serves a market.

But the trends suggest that market is shrinking, fragmenting, and facing competition from multiple directions. The Houzez theme business was under financial pressure when my payments began. That pressure has only increased.

Anyone considering the Houzez real estate WordPress theme should research accordingly.

Related: The Full Investigation

This market analysis is part of a larger investigation into my experience with Waqas Riaz and the Houzez development team. For the complete picture:

- My Story: How I Lost $83,000 — The full personal account of 14 months of payments and broken promises

- GitHub Forensic Analysis — Technical evidence showing where development resources actually went

- The Evidence — Payment records, communications, and documentation

Data captured: January 3, 2026 Sources: Google Trends, Ubersuggest keyword data for Houzez theme, Shutterstock/Envato acquisition filings, NAR 2026 housing forecast, industry SaaS platform research, documented communications This Houzez WordPress theme review presents publicly available search data and documented evidence for educational purposes.